9 Reasons Why Students Prefer JKSC For Commerce Coaching!

Qualified Competent Teachers

Exhaustive Study Material

Revision & Live Doubt Solving Sessions

Concept-Based Teaching Technique

Timely Completion Of Syllabus

Comprehensive Test Series

Online & Classroom Lectures

Non-Teaching Support

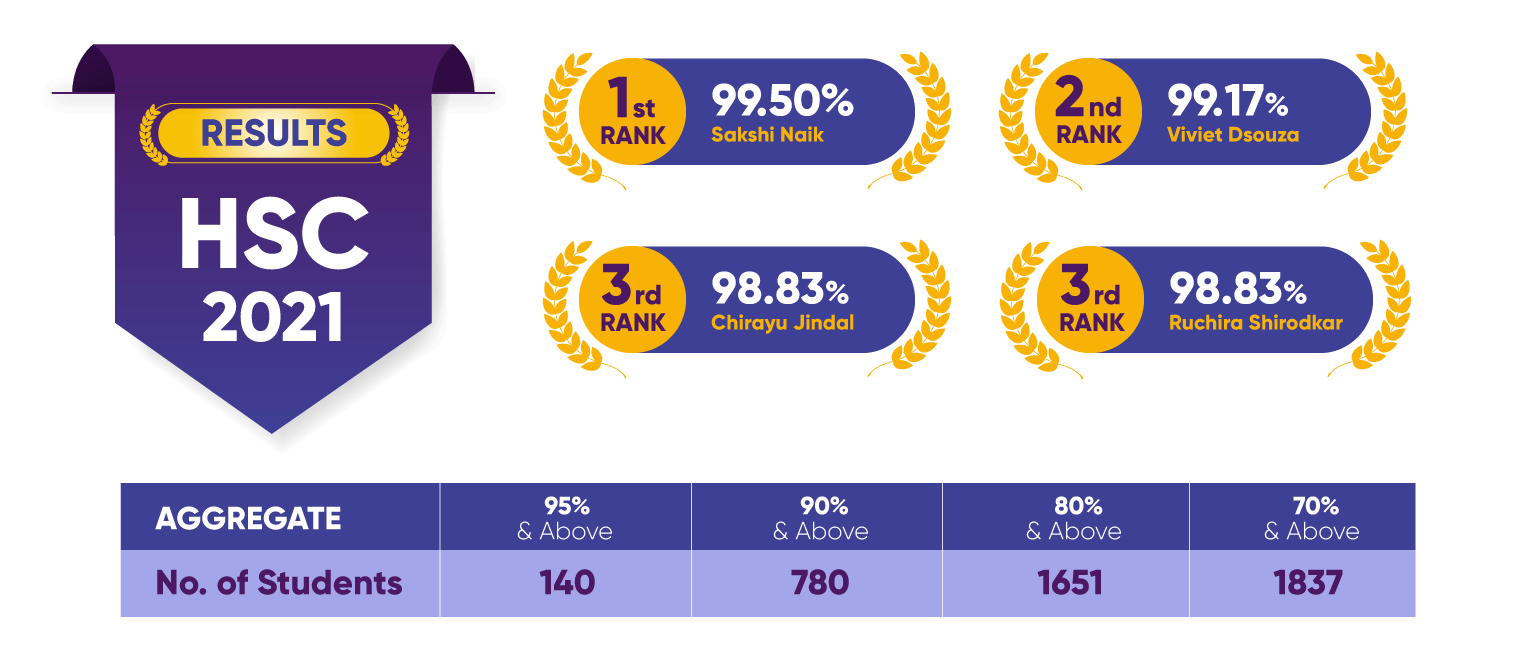

Consistently growing results

Qualified

Competent

Teachers

Exhaustive

Study

Material

Revision & Live

Doubt Solving

Sessions

Concept-Based

Teaching

Technique

Timely

Completion

Of Syllabus

Comprehensive

Test

Series

Online &

Classroom

Lectures

Non-

Teaching

Support

Consistently

growing

results

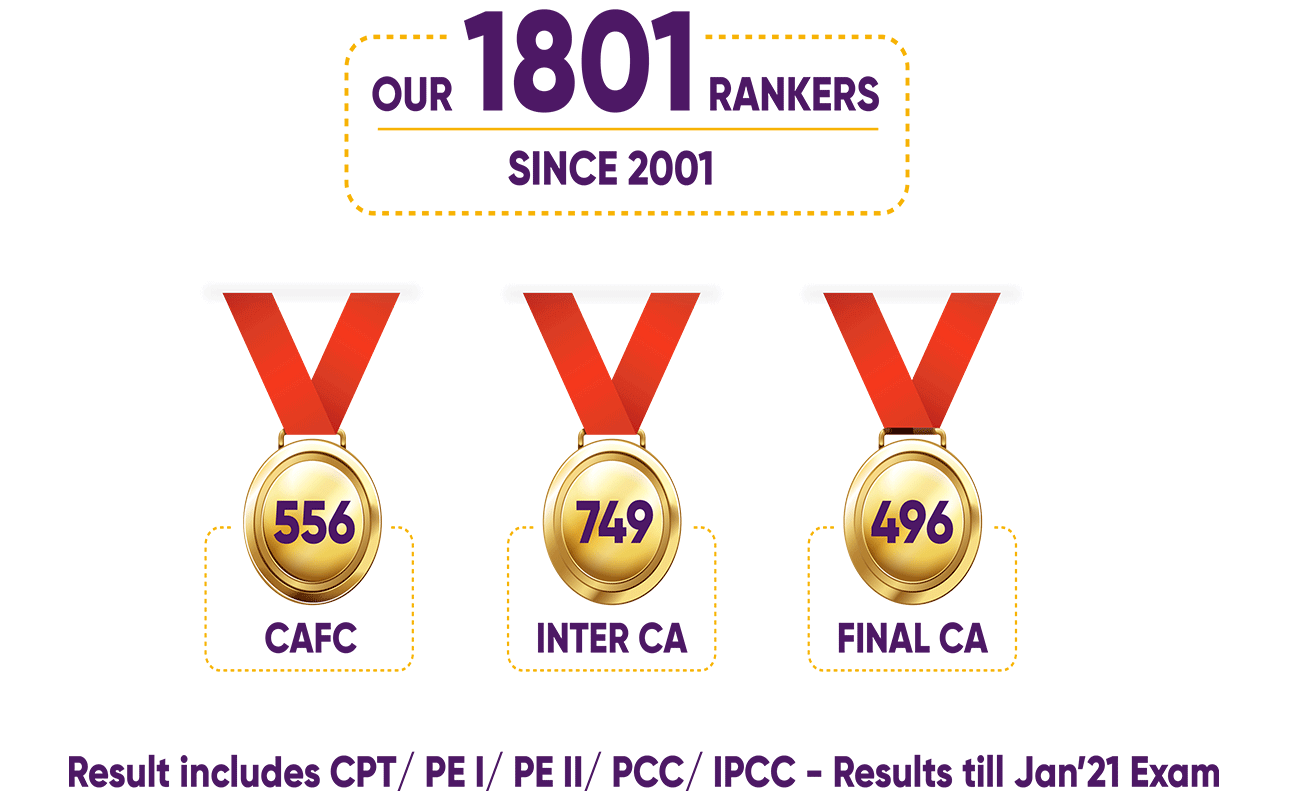

Our Numbers Speaks

The Rankers' Factory

Frequently Asked Question

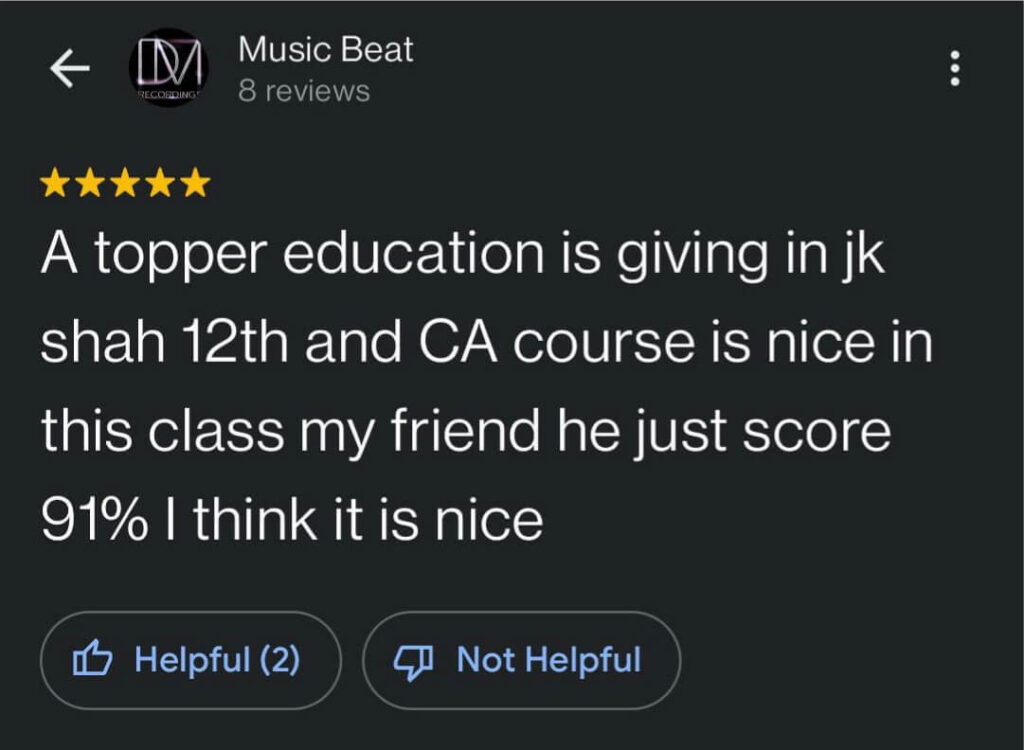

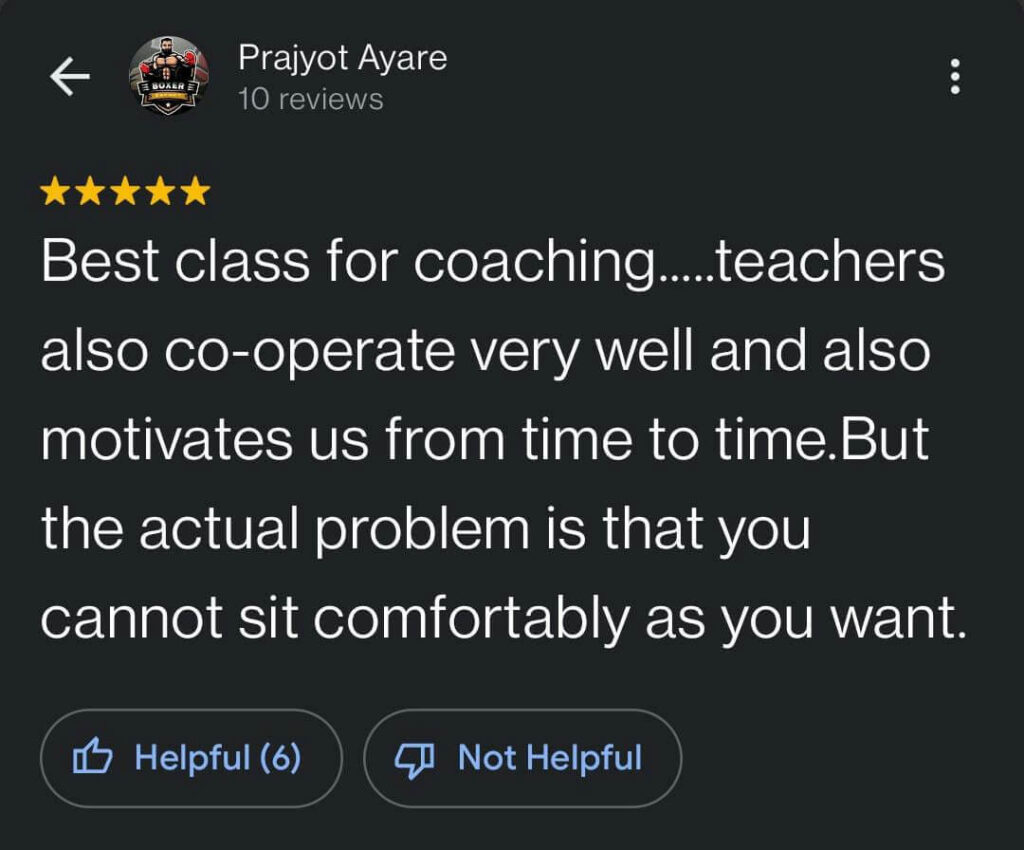

J.K. Shah Classes is giving college and board toppers, rankers in CA and CS & CMA from the last 38 years. In HSC 19 – 20, the topper – KHUSHBU MALI who scored 95.53% is our student and 324 Students scored 90 % plus. All toppers from good colleges are from JK Shah Classes like Priyanka Udeshi from NM College Scored 94.92%.

We provide study material which includes Government textbooks, Last Minute Revision book (LMR), Chapter wise question papers with solutions that are exclusive and exhaustive, and you don’t need to buy any study materials from outside.

Difference between CA and CFA

I. CA is treated as an expert in Accounting, Taxation, and Audit & Finance. CFA has a core focus on Finance.

II. CA’s are only authorized to audit the Financial Statements of the Company. CFA’s are not authorized to audit the Financial Statements of the Company.

III. CA Course offers the flexibility to work in different job profiles such as audit, finance & Taxation as well as CAs are eligible to set up their own practice. The CFA on the other hand have demand in investment management job profile.

IV. The cost of pursuing CFA is comparatively higher than pursuing CA

V. CFA has more demand in the international market whereas CA has demand in Indian as well as international market

Difference between CA and ACCA

I. An ACCA does not have the authority to sign audit report in India. A practicing CA has the authority to sign the audit report in India.

II. The course fee of ACCA is comparatively higher than course fee of CA.

III. The average starting salary of CA is higher than ACCA in India as ACCA is mainly structured for the global market and CA is structured for Indian market.

IV. CA Course offers the flexibility to work in different job profiles such as audit, finance & Taxation as well as CAs are eligible to set up their own practice. ACCA on the other hand have demand in with MNC’s